Like a sole proprietorship, a partnership can be formed without paperwork. Choosing a business entity is one of the first steps that a business should take. It affects what tax forms you’ll file and what would happens if your business were sued. Many business structures offer protection for your personal assets.

General Partnerships

William Perez is a tax expert with 20+ years of experience in individual and small business taxes. He has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification. To hedge against stock market volatility and inflation, some IRA owners and investors put money into precious metal… For example, they must have 100 or fewer shareholders, all of whom must be U.S. citizens or residents, and they can issue only one class of stock.

This move can provide better liability protection and allow for more flexible tax planning, potentially contributing to rapid growth. A corporation is a separate legal entity from its owners and owners have limited liability for debts, lawsuits, and other liabilities of the business. Like a limited liability company, a corporation has to be registered with the state before it can conduct business. Investors in corporations are subject to what is commonly termed “double taxation”.

Types of Business Entities

This is accomplished by granting the corporation independent legal status from the company. The taxes and liabilities pass through the business, and the partners pay sole-proprietorship taxes based on their share of the income. It’s also much harder to find small-business financing as a sole proprietor. When you form a separate legal entity, you have a business credit score and an easily tracked business record—two important factors in obtaining most small-business loans.

You can also offer this stock to your employees as part of their compensation. The impact of your business entity selection extends beyond initial formation. It influences financial handling, strategic decision-making, and interactions with partners, investors, and customers. The business entity definition you choose will have long-lasting effects on your company’s structure and operations. When you establish a business entity, you create a distinct legal identity for your company.

Owners are known as “members,” and an LLC can be structured as a single-member or multimember entity. As the name implies, partnerships are formed when two or more people agree to run a business together. There are several types, including general partnerships, limited partnerships and limited liability partnerships, each offering varying levels of liability protection.

Because your income will now be separate from the income of the business, you’ll have to deal with double taxation. Double taxation means the profits of your business are taxed, and then the personal income paid to you and your shareholders is also taxed. As a corporation, you’ll be able to issue stock, making it easier to generate financing for the growth of your company. At first, you may choose to issue this stock to those you trust to own shares in your business, but over time, other businesses and individuals may try to buy shares from your stockholders.

What Are ‘Disregarded’ Business Entities?

Businesses can benefit from limited liability for owners in the same manner that corporations can, but they also have the flexibility of partnerships. Another advantage is that an LLC is significantly easier to set up and register than a corporation. Your family’s well-being is dependent on the success of your business, so choose the correct structure and establish a long-term plan.

- Additionally, limited partnerships exist, where one or more partners invest money in the business and receive a portion of its earnings or losses without actively managing it themselves.

- On the other side, your company’s name influences what it does and how it communicates with clients, customers, and employees.

- Another advantage is that an LLC is significantly easier to set up and register than a corporation.

- Even large corporations can enter into joint ventures with other groups or individuals.

- In many places, an LLC has one owner only; they operate like a sole proprietor but have the advantage of limited liability.

This is a special type of corporation that you can create only after your business is already an approved C corporation. To qualify as an S corporation, your business must have 100 shareholders or fewer. It prevents you from being personally responsible for any liabilities your business incurs. There are a few different kinds of partnership agreements common in the small-business space. The problem is it’s hard to find a trusted advisor who can translate financial jargon to layman’s terms and who can actually help you plan for better results. Many people are surprised to learn that nonprofit organizations are also technically businesses, even though their primary goal isn’t to make money.

Business owners can face various risks and rewards depending on the regulations they follow. We’re going to take a look at the business entity and discuss related matters in this topic. The concept of business entities has been around since the beginning of organized commerce.

Corporations: Maximum Protection, Complex Structure

- Income from specified service businesses generally doesn’t count as QBI if the owner’s taxable income (not counting any potential QBI deduction) exceeds the applicable level.

- A general partnership is an agreement between two or more people who join together to run a business.

- This is the most common type of business entity because it allows you to do business under your own name without going through the legal process of creating a separate entity.

- Each individual person has to pay self-employment taxes, including employees.

Second, while economic entity is a principle of accounting, limited liability is a form of legal protection. A general partnership is an unincorporated business with two or more owners. It’s the default form of ownership for businesses with multiple owners. As with a sole proprietorship, your personal assets could be at risk if your business were sued, but all of the partners share that risk. You file one tax return with this business entity, rather than separate business and personal tax returns.

Legal and Financial Separation

At Clear View Business Solutions, we often see entrepreneurs struggling with this decision. Being self-employed can be rewarding, but as your business grows, you might wonder, “Do I need a business entity? ” Understanding what a business entity is and the different kinds of entities can help you decide the best structure for your business. Multi-owner businesses that want to raise money from investors often do well as LPs because investors can avoid liability.

It is established at the state level, hence requiring its members to adhere to the rules of that state. In order to officially incorporate their business, most states need business owners to submit certain documents to a governmental agency, such as the Secretary of governmental’s office. There is a legal form that allows a group of persons to conduct business together. The setup and operation of a business myths about doing your own taxes are critical as they determine how taxes are calculated and who is responsible for fulfilling the company’s obligations and duties.

Easier Business Management

In this article, we’ll explain what a business entity is, the different types and share some common examples for small, self-employed businesses. Many external stakeholders use the records maintained by a business. Governments and investors use a company’s financial records to assess its performance.

Tax penalty protection

There’s no one-size-fits-all answer, as the “best” trucker software depends on your specific user needs, budget, and scale. If you have 1-5 trucks, don’t overcomplicate it; you likely can run off of Google Sheets. If you have a growing 5-50 truck asset-based fleet with multiple office employees, you’re likely best off with a modern cloud-based solution like Truckbase. Without such integrations, document management quickly becomes overwhelming. Saving rate confirmations and attaching the right one to the right invoice can become unwieldy.

PCS TMS for Carriers brings all of your technology under one roof, thanks to seamless integration capabilities. Manage your business — and your finances — in less time, and focus on growing your fleet. Contact us for personalized guidance and solutions, and discover how QuickBooks for trucking can revolutionize your financial management. Just like customer invoices, payroll and IFTA can be automatically synced to QuickBooks, so that your accounts stay up to date without any fuss.

Why choose Shoeboxed over QuickBooks?

QuickBooks can sync your finances and account information across all your devices, including the iPad, iPhone and Android. The app provides real-time payables, receivables, and cash flow, and prepares your data for tax time. The QuickBooks dashboard’s color-coded approach makes it easy to track open invoices, overdue bills and your overall cash balance. QuickBooks also allows you to personalize and send your invoices from anywhere at any time, and it deposits money into your bank account when you get paid.

4. Simplify driver pay and IFTA reporting

If you can’t integrate the two platforms, manual data entry becomes a larger part of accounts receivable operations. Errors and rebills increase, and accounting departments struggle to keep track of invoices. The chart of accounts is a list of all of your company’s accounts, including assets, liabilities, income, and expenses.

Smaller trucking companies that are still growing can use QuickBooks to meet the basic bookkeeping requirements, and use Excel for anything else. In this case, you already know what’s missing from QuickBooks, and you’re okay with it. In this article, we’ll explore using QuickBooks as your primary accounting software for a trucking company. Fuel is one of the biggest expenses in the trucking industry, and finding ways to cut costs can make a significant impact on profitability.

factors to consider regarding trucking software integration with QuickBooks

Many small trucking companies still use ledgers, spreadsheets and file drawers when managing their financials. If your company falls into that category, there are easy ways to do accounting without all the paperwork. Online accounting software allows you to update and track your financials in real-time for as little as $10 a month.

With Rigbooks, you’ll get an overview of the cost of each load and can access features from any device, anywhere. Expenses are automatically organized into neat reports with images of the receipts attached. When you approve the summary, Shoeboxed will generate a receipt with your trip information, including a photo of your route on the map, and auto-categorize it under the mileage category. At the end of a trip, Shoeboxed creates a summary that includes the date, editable mileage and trip name, and your tax deductible and rate information.

- Discover how freight tech is revolutionizing the trucking industry and increasing efficiency through AI and augmented intelligence.

- QuickBooks can sync your finances and account information across all your devices, including the iPad, iPhone and Android.

- Formerly known as KeepTruckin, this all-in-one platform provides Electronic Logging Devices (ELDs), GPS tracking, and safety monitoring for truck drivers and fleet managers.

- TruckingHQ is here to help transportation companies navigate regulation, compliance, and back office paperwork.

Using QuickBooks as your main accounting platform as a trucking company can be done, but it won’t be easy. Having your accounting in the same software as your dispatch, maintenance, and fuel taxes is preferred for most trucking companies. Keeping your fuel and mileage data under the same roof as your accounting software is far more efficient than managing everything in two or more places. Trucking software will be able to produce an IFTA report for you using your fuel and mileage data.

As mentioned in the article, we strongly recommend that you use QuickBooks Online for its flexibility and regular updates. An integrated solution allows for automatic invoice generation based on rate cons and dispatch information. You should be able to generate invoices either from within your TMS or QuickBooks. Additionally, you should have it sync automatically with the opposing system. The TMS lets you create and dispatch loads, create and send invoices, and manage payments. Shoeboxed is a receipt-scanning app and service that lets truckers manage expenses and digitize receipts right from their cabins.

Streamlined Audits and Tax PrepBecause your financial records are accurate and up to date, audits and tax season become far less stressful.

Streamlined Audits and Tax PrepBecause your financial records are accurate and up to date, audits and tax season become far less stressful.- The most common reasons truckers use QuickBooks is that “everyone uses it” or that their accountant recommended it.

- Overall, Rigbooks is a good option if you’re looking for a way to reduce costs and increase profits by the mile.

- Inversely, QuickBooks doesn’t meet all the flexibility that a carrier TMS provides.

- PCS TMS for Carriers is the total package, with integrated trucking accounting features that speed up the invoicing process and ensure accuracy.

In Toro, invoices are automatically prepopulated with key details like PO numbers, BOL references, and pick-up/drop-off locations—all you need to do is click “Create invoices”. Integrating your TMS with QuickBooks ensures that such documents are seamlessly attached and registered in both systems. Inversely, QuickBooks doesn’t meet all the flexibility that a carrier TMS provides. It’s essential to choose a TMS that can integrate with QuickBooks without compromising on flexibility to meet your unique business needs.

You can manually enter each transaction, or you can connect your bank account and credit cards to automatically import your transactions. It’s important to categorize each transaction correctly, so it’s easy to track your income and expenses. The first step in using QuickBooks for your trucking company is to set up your account. You can choose between the desktop version or the online version, depending on your preference. Once you have your account, you’ll need to enter your company’s information, including your business name and address, tax ID number, and bank account information. Driver pay can be complex, as different drivers may be paid by the load, hour, or mile.

For the busy truck driver, manual data entry is a significant drain on time and accuracy. Manually tracking these intricate financial details in generic spreadsheets is highly prone to errors, leading to missed write-offs, inaccurate reporting, and significant audit risks. Sure all businesses share some basic needs like keeping track of revenue and expenses, and QB can handle that well, but your trucking company has specific needs to make you successful. The root of the problem with using QuickBooks for trucking is that it’s one-size-fits-all accounting software. They want to be able to sell it to everyone, so it has to work just as well for a plumber or florist as it does for your trucking company.  Real-Time Cash Flow ManagementTrack revenue, fuel costs, and expenses as they happen.

Real-Time Cash Flow ManagementTrack revenue, fuel costs, and expenses as they happen.

We’ll walk through a lot of these in this article so you will have a better idea if it makes sense to use QuickBooks for your trucking business. Then you can decide if you want to use QuickBooks, or if something made specific for trucking makes more sense. Learn about deadhead trucking, which refers to the miles a trucker drives with an empty trailer between loads.  Streamlined Audits and Tax PrepBecause your financial records are accurate and up to date, audits and tax season become far less stressful. All the data your accountant needs is already in QuickBooks—clean, organized, and ready to go.

Streamlined Audits and Tax PrepBecause your financial records are accurate and up to date, audits and tax season become far less stressful. All the data your accountant needs is already in QuickBooks—clean, organized, and ready to go.

Our Strategy Live system offers an entirely cloud-based solution that’s easy to install, learn and use and provides real-time access to critical operational data. New Zealand-based Xero is aiming to replace QuickBooks as the top accounting software for U.S. businesses. Xero offers real-time tracking of accounting transactions and customizable invoices that customers can pay digitally. The software’s account reconciling feature is easy to use and allows you to perform what was once a time-consuming task within minutes. That flexibility lets you consolidate your company’s accounting with project management and client relationship data. Trucking software is commonly referred to as transportation management system (TMS) or fleet management software.

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. QuickBooks’ receipt scanner is finicky, so tracking expenses on the go may prove to be more of a headache than you anticipated. With the lack of industry-specific features, getting QuickBooks to meet all of your needs as a trucker or dispatcher will be a challenge, and in some cases, impossible. While QuickBooks has features that can benefit those in the trucking industry, it also has a lot of useless features—at least for truckers. Before we dive into QuickBooks’ drawbacks, let’s discuss how QuickBooks Online can benefit small businesses in the trucking industry.

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Upon receiving the machine and realizing how outrageously impractical their impulse i filed an irs return with the wrong social security number buy was, they sent it back. Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

Return of Merchandise Sold on Account

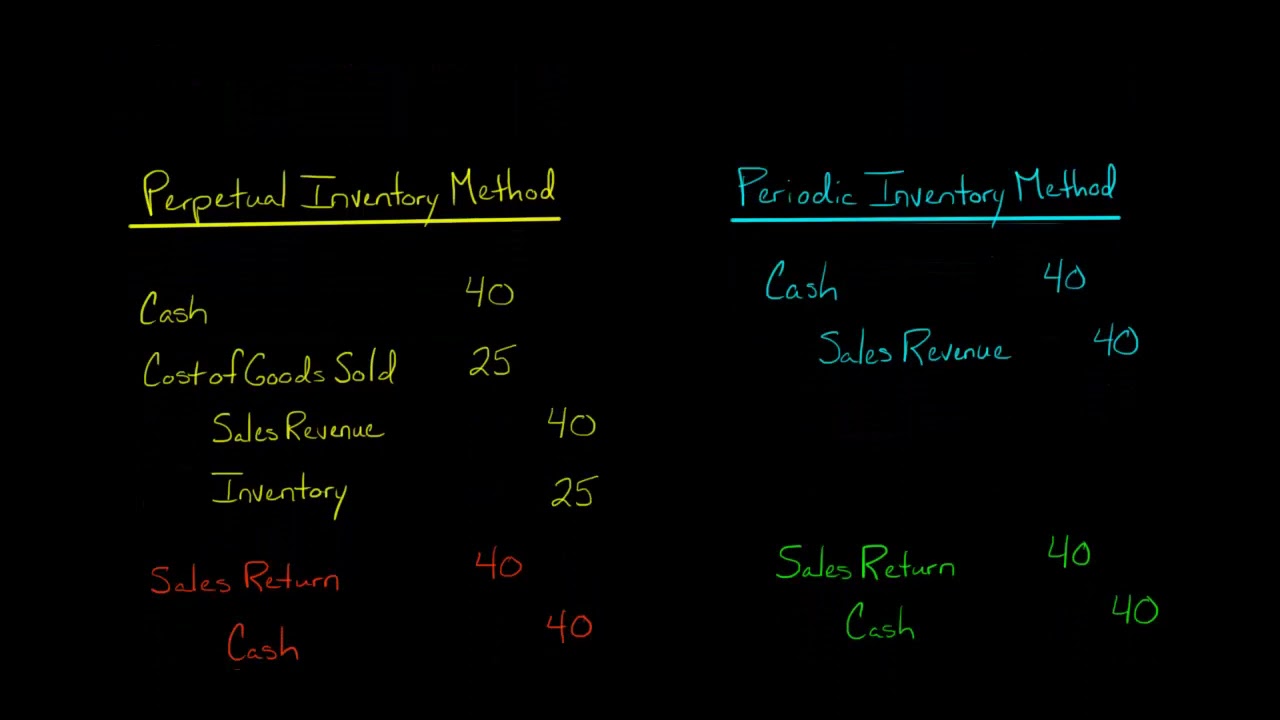

Sales returns and allowances is a contra revenue account with a normal debit balance used to record returns from and allowances to customers. The account, therefore, has a debit balance that is opposite the credit balance of the sales account. To reverse the return’s related revenue, you have to debit your sales returns and allowances account by the amount of revenue generated by the original sale. Then, you have to credit your accounts receivable or cash account by the same figure. A seller will then have to record a sales return by debiting a Sales Return and Allowances account and crediting the Accounts Receivable account in a case where the sale is made on credit. The credit to the accounts receivable account will reduce the outstanding amount of accounts receivable.

How to Record a Sales Revenue Journal Entry

The journal entries for sales returns from XYZ Co. are as follows. Instead of debiting the sales returns account, companies will debit the sales allowances account. Like other contra accounts, the contra revenue account goes against revenues in the income statement.

Are the Accounts Receivable Current or Non-assets?

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency. Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price. So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited.

To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances. In a single-step income statement, we do not present the sales return and allowances separately. When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts. Therefore, sales returns should not cause too much concern for companies.

- A company may choose any approach depending on its volume of returns and allowances transactions during the year.

- If no sales returns and allowances account is there, the revenue reversal entries will be different (as shown below).

- This sales return allowance account is the contra account to the sales revenue account.

- Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales.

- During this process, the goods may go under physical changes or deformities.

- To arrive at net sales, we take the gross sales or simply sales revenue minus sales discount as well as sales return and allowances.

Similarly, it will include the terms and conditions for which the returns will be acceptable. Revenues define the income from a company’s operations during an accounting period. These revenues may arise from the sale of either goods or services. Regardless of their source, revenues play a significant role in a company’s profits and success. Therefore, companies strive to increase the numbers as high as possible.

All returned items and items subject to discounts/allowances must be reflected in the company’s income statement. These returns and allowances, in turn, reduce either credit sales, accounts receivable, or cash in the company’s balance sheet. In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues. In some cases, companies might not include sales returns and allowances as a separate account. Instead, they record sales returns and allowances by directly debiting their sales accounts before crediting their accounts receivable or cash account.

In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account. By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn. The accounts receivable account is debited to indicate that ABC Electronics has sold the desktop computers and is expecting to receive $6,000 from customers. The sales revenue account is credited to show the income earned from the sale, which increases the company’s equity.

And with globalization, the number of partners involved in these processes has only increased. When using FOB Shipping Point or FOB Destination, it is important to comply with all legal requirements and regulations. Buyers and sellers should consult with fob shipping point means legal experts and ensure that their contracts are legally enforceable. Cross-check all shipping documents in terms of consistency with agreed FOB terms. As such, in EXW, maximum responsibility is vested with the buyer, though in FOB, liability is partially placed on the seller until goods are laden in a shipping vessel. The buyer and seller must prepare and provide all the necessary customs documentation.

Determining Which FOB Term to Use

From a practical perspective, recognition of receipt is instead completed at the receiving dock of the buyer. Thus, the sale is recorded when the shipment leaves the seller’s facility, and the receipt is recorded when it arrives at the buyer’s facility. This means there is a difference between the legal terms of the arrangement and the typical accounting for it. Since the buyer takes ownership at the point of departure from the supplier’s shipping dock, the supplier should record a sale at that point. Also, under these terms, the buyer is responsible for the cost of shipping the product to its facility.

DDP means “delivered duty paid.” Under this Incoterm rule, the seller agrees to deliver goods to the buyer, paying for all shipping, export, and import duties and taxes. CIP stands for “carriage and insurance paid to” says that the seller pays for delivery and insurance of goods to a carrier or nominated location. Beyond those costs, FOB terms also affect how and when a business will account for goods in its inventory. Shipping costs are usually tied to FOB status, with shipping paid for by whichever party is responsible for transit. Hopefully, the buyer in this example took out cargo insurance and can file a claim.

As goods travel through oceans to reach their destination, charges add up, increasing the cost per unit. Cost, Insurance, Freight (CIF) puts the liability of payment for – you guessed it – cost, insurance, and freight on the supplier. Once the delivery is unloaded in the receiving country, responsibility is transferred to you.

Advantages for buyers

These standards outline the respective responsibilities of buyers and sellers during export transactions. Each of these terms carries distinct implications for ownership, liability, and costs in the supply chain. Beyond the fundamental concepts of FOB shipping point and FOB destination, there are several specific FOB terms that businesses may encounter in their shipping agreement. Understanding the accounting implications of Free On Board (FOB) terms is vital for businesses engaged in international trade.

Transfer of Ownership and Risk

This can affect the seller’s competitiveness in the market, as buyers may opt for lower-priced alternatives. FOB stands for either “free on board” or “freight on board.” The term is used to designate buyer and seller ownership as goods are transported. For example, assume Company XYZ in the U.S. buys computers from a supplier in China and signs a FOB destination agreement. If an accident prevents the computers from being delivered, the supplier takes full responsibility for the computers and must reimburse Company XYZ or reship the computers. For example, in FOB shipping point, the buyer is responsible for freight, insurance, and other costs from the shipping point onward.

Step Customs Clearance

But when it comes to fulfilling orders and getting your products to your customers, understanding trade terms like FOB Shipping Point (FOB SP) is crucial. Here’s how Strikingly can empower you to navigate FOB SP deliveries and streamline your online business operations. FOB Warehouse plays a crucial role in ensuring that goods are stored and handled properly before they are shipped to their final destination. Choosing the right warehouse can greatly improve the efficiency and cost-effectiveness of shipping operations.

- From selecting the carrier to deciding on the shipping route, buyers have the control and flexibility to make strategic choices that align with their business needs.

- Conversely, FOB Destination increases shipping costs for the seller as they cover the entire transportation process.

- Incoterms are published and maintained by the International Chamber of Commerce (ICC).

- This helps in optimizing costs and shipping time to increase sourcing efficiency.

- F.O.B. shipping point is widely used in manufacturing, retail, and e-commerce industries.

Rakesh Patel, author of two defining books on reverse geotagging, is a trusted authority in routing and logistics. His innovative solutions at Upper Route Planner have simplified logistics for businesses across the board. A thought leader in the field, Rakesh’s insights are shaping the future of modern-day logistics, making him your go-to expert for all things route optimization. Notably, some Incoterms are designed exclusively for sea transport, while others are versatile enough for any mode of transportation. Free on board is one of around a dozen Incoterms, or international commercial terms. Incoterms are published and maintained by the International Chamber of Commerce (ICC).

It includes Commercial invoice, Bill of lading/Airways bills, the packing list, and Certificate of origin. In FOB Origin, the seller pays freight at his place of origin, but the charges are incorporated into the buyer’s invoice. Conversely, in FOB Destination, the seller collects Freight after it arrives at the buyer’s place.

Managing freight delivery with FOB Shipping Point and FOB Destination requires careful planning and attention to detail. Best practices include properly packaging the goods, selecting qualified carriers, and communicating openly with buyers or sellers throughout the transportation process. If you’re involved in the world of freight shipping, you may have heard the terms FOB Shipping Point and FOB Destination thrown around. In this article, we’ll dive into the details of each, exploring their pros and cons, legal requirements, negotiation tips, best practices, and more. By the end, you’ll have a comprehensive understanding of the difference between FOB Shipping Point and FOB Destination and how to choose the right option for your freight needs.

Goods in FOB shipping point are owned by the buyer once loaded onto the freight carrier at the origin point. From selecting the carrier to deciding on the shipping route, buyers have the control and flexibility to make strategic choices that align with their business needs. The most common international trade terms are Incoterms, which the International Chamber of Commerce publishes, though firms that ship goods within the U.S. must adhere to the Uniform Commercial Code. If you’re ordering many products from a single seller, you may have more leverage to negotiate FOB destination terms, as the cost of shipping per unit will likely be lower for the seller. DAP, or “delivered-at-place,” says a seller agrees to be responsible for transporting goods to a location stated in the sales contract. There are 11 internationally recognized Incoterms that cover buyer and seller responsibilities during exports.

- Each of these terms carries distinct implications for ownership, liability, and costs in the supply chain.

- FOB (Free On Board) puts more responsibility on the buyer after goods are loaded, with the buyer covering costs and insurance.

- Advances in logistics technology will further enhance the management and tracking of shipments under F.O.B. terms.

- They would incur charges for insurance and freight, and the buyer bears these costs in FOB after loading.

- The choice between FOB Origin and FOB Destination depends on various factors, including the nature of the goods, the parties’ risk preferences, and the complexities of the supply chain.

Alternatively, FOB destination places the delivery responsibility on the seller. The seller maintains ownership of the goods until they are delivered, and once they’re delivered, the buyer assumes ownership. In this case, the seller completes the sale in its records once the goods arrive at the receiving dock. The accounting entries are often performed earlier for a FOB shipping point transaction than a FOB destination transaction. Shipping terms affect the buyer’s inventory cost because inventory costs include all costs to prepare the inventory for sale. This accounting treatment is important because adding costs to inventory means the buyer doesn’t immediately expense the costs, and this delay in recognizing the cost as an expense affects net income.

This may result in higher prices for the buyer, as the seller may need to factor in these additional costs when setting their prices. One advantage of using FOB Destination is that the buyer has more control over the shipping process. Since the seller is responsible for arranging transportation, the buyer can choose the carrier and shipping method that best suits their needs. Additionally, the buyer can track the shipment and communicate directly with the carrier if any issues arise during transit. It could be either its origin or destination, so you can opt for any specific point. In a FOB Destination agreement, shipping arrangements are under the seller’s control until delivery.

Manufacturers use F.O.B. shipping point to reduce transportation costs and lead times, enabling faster delivery to retailers. Retailers leverage F.O.B. shipping point to enhance inventory management and respond quickly to market demands. Similarly to FOB shipping point, the seller is responsible for providing the necessary shipping documents. However, in FOB destination contracts, the seller must ensure that the documents accurately reflect the destination and any specific requirements for import clearance. In FOB destination contracts, the ownership of the goods remains with the seller until the goods arrive at the agreed-upon destination. This means that the seller retains responsibility for any loss or damage to the goods until they reach the destination.

You can only use dollars from your pretax DCP balance. However, you can take a distribution from your Roth and use it to purchase additional service credit. You can choose to contribute to both or either option. You’ll be able to review and access both balances using your online account. The combined contributions for both options must fall within IRS annual limits. Box 1 on form W2 reflects your taxable gross earnings.

File your taxes, your way

- The amount shown in box 14 as UCRP, is the amount of retirement compensation you earned.

- Viewing past performance can provide you with insight into how a particular investment works and can help you determine what is “normal” behavior for an investment.

- For specific tax information, consult your tax advisor.

- IRA contributions may still qualify for a full or partial income tax deduction, depending on your adjusted gross income and tax filing status.

The Payroll Office cannot supply tax return forms, but see next question. Transfers among funds are allowed at any time on Fidelity’s website. Some restrictions apply to transfers into or out of the ICC Fund. The DCP is a qualified retirement plan administered by the University of California Employee Benefits Office in the Office of the President. PerformancePast investment performance is no guarantee of future results. So why do we share past performance if it can’t predict future returns?

So every quarter would be calculated based on the exact account balance and performance at the time. While DRS and the DCP record keeper can provide you with information about investments, we cannot offer investment advice. If you are still not sure which investment approach might be right for you, talk with your financial advisor.

- For this example, let’s use the 2035 Retirement Strategy Fund for DCP.

- A student who loses exemption status will contribute on a pre-tax basis 7.5% of gross wages to the Defined Contribution Plan and 1.45% of earnings to Medicare.

- This example is simplified because normally your investments would vary each quarter depending on your contributions and the performance of the market.

- Rollovers can include a rollover out (moving funds out of an account) and a rollover in (moving money into an account).

- You can also contact the record keeper for assistance.

Information for beneficiaries

To find out more about each fund, see each investment’s Fund Fact Sheet (linked within each plan’s section). These fact sheets are prepared by the fund managers and contain information about performance, asset mixes and the goals of the fund. Make investment changes through your online account. Change your fund selections anytime during or after your employment. You can also contact the record keeper for assistance. The management cost for the individual investment and the administrative costs applied to all plan investments.

Your portfolio should include investments in several different objective categories. Spreading your assets among different types of investments might help you achieve a favorable rate of return while minimizing your overall risk of losing money. Although diversification is not a guarantee against loss, it is an effective strategy to help you manage investment risk. If the DRS record keeper, Voya Financial denies your request for distribution, you’ll receive a letter with instructions to request further review by DRS if you wish. If you are rolling eligible Roth funds into DCP, you’ll need to know the date you started contributions for the account.

If you roll your DCP funds directly over into a traditional IRA or eligible retirement plan, the funds won’t be taxed dcp-cas w2 until you withdraw them. If you roll over into a Roth account, the rules could be different. Check with the IRS to learn how this choice will impact you. DCP offers a variety of professionally managed investment options, including “one-step” funds that automatically rebalance the asset mix as you move toward your target date for retirement.

Once you are enrolled in DCP, update your beneficiaries online through /oaa. Or complete the paper form (Beneficiary Designation) and mail it to DRS. You will receive a 1099 tax statement for the year of the withdrawal. Your contributions will be invested in the Retirement Strategy Fund that assumes you’ll begin withdrawing funds at age 65. This means if you were contributing to both options, you’d be contributing at least 1% each to Roth and 1% to pretax.

How is the minimum payment calculated?

These dollars remain in the pension trust fund and are only available to you as part of a monthly pension retirement income. To calculate your own RMD withdrawal, use the table linked below. The distribution period is the number you divide your total investment account balance by to get the required minimum amount. With the DCP Roth option, your contributions are deferred from your already taxed income. Roth withdrawals, including any investment earnings, are not taxed if you meet the minimum qualifications.

Less tax on your withdrawals could mean more money in your pocket during your retirement. Your retirement savings needs may vary—talking with a financial professional can help you determine which option is best for you. This information about required minimum distributions is a summary.

Payroll

As explained in items A and B below, there are certain types of student income which are exempt from Student FICA. International students who are nonresident aliens are always exempt from Student FICA. The body of the receipt will contain the explanation under “Deduction” that an amount has been withheld for “DCP CAS SAV R” or DCP Casual Savings Reduction. During the academic year, a registered graduate student who has advanced to Ph.D. candidacy is not subject to the unit requirement but is subject to the less than 80% requirement.

With the One-Step Investing approach, your Retirement Strategy portfolio is already well diversified and will automatically adjust as you move closer to your target date. With the Build and Monitor approach to investing, you can allocate your contributions among the seven available funds to achieve diversification. At this time, DRS is not implementing the optional SECURE 2.0 Act provision that increases catch up contributions for individuals age 60 to 63. Automatic enrollment does not include student employees or retirees returning to work, even if they fit the newly hired/full time employee status. For tax reporting purposes, wages are reported when they are paid, rather than when they are earned.

If you separate from employment and later return to work for an employer who participates in DCP, you can reenroll anytime. If any payments from your account have started, they will stop. Because DRS only recovers the cost of administering DCP, we keep the fees low. The DCP administrative costs include WSIB, recordkeeping and the DRS administrative cost.

How to withdraw from DCP

The DRS record keeper maintains the records for Plan 3, DCP and JRA customer investment accounts and assists customers with transactions related to these accounts. Voya Financial is the DRS record keeper for DCP, Plan 3 and JRA customer investment accounts. They can assist you with transactional needs and account information. The percentage is calculated from the total gross salary for the pay period, before any deductions are applied.

The accounting equation is a fundamental concept that states that a company’s total assets are equal to the sum of its liabilities and its shareholders’ equity. This straightforward relationship between assets, liabilities, and equity is the foundation of the double-entry accounting system. The accounting cycle is the process by which a company records and reports its financial transactions. It includes several steps, such as journalizing transactions, posting to the general ledger, preparing trial balances, and creating financial statements.

The accounting equation is a core principle in the double-entry bookkeeping system, wherein each transaction must affect at a bare minimum two of the three accounts, i.e. a debit and credit entry. On a more granular level, the fundamentals of financial accounting can shed light on the performance of individual departments, teams, and projects. Whether you’re looking to understand your company’s balance sheet or create one yourself, the information you’ll glean from doing so can help you make better business decisions in the long run. A balance sheet is one of the primary statements used to determine the net worth of a company and get a quick overview of its financial health. The ability to read and understand a balance sheet is a crucial skill for anyone involved in business, but it’s one that many people lack. Balance sheets are one of the primary statements used to determine the net worth of a company and get a quick overview of it’s financial health.

What is an example of assets, liabilities and equity?

Some companies issue preferred stock, which will be listed separately from common stock under this section. Preferred stock is assigned an arbitrary par value (as is common stock, in some cases) that has no bearing on the market value of the shares. The common stock and preferred stock accounts are calculated by multiplying the par value by the number of shares issued. Assets will typically be presented as individual line items, such as the examples above. Then, current and fixed assets are subtotaled and finally totaled together.

Retained earnings are the accumulated net income of a company that has not been distributed as dividends to shareholders. Instead, these earnings are reinvested in the company to improve operations, pay off debts, or fund expansion projects. Retained earnings play a crucial role in growing a company and increasing its equity value over time. Receivables arise when a company provides a service or sells a product to someone on credit. A corporation’s own stock that has been repurchased from stockholders. Also a stockholders’ equity account that usually reports the cost of the stock that has been repurchased.

Cash

When a company records a business transaction, it is not recorded in the accounting equation, per se. Rather, transactions are recorded into specific accounts contained in the company’s general ledger. The accounts are designated as an asset, liability, owner’s equity, revenue, expense, gain, or loss account. The amounts in the general ledger accounts will be used to prepare the balance sheets and income statements. The general ledger is the central repository for a company’s financial transactions. It is important to ensure that the general ledger is accurate and up-to-date, as errors in the ledger can affect the basic accounting equation and the financial statements that are produced.

In all financial statements, the balance sheet should always remain in balance. Equity is the sweet spot—the difference between what you own and what you owe. It’s the owner’s residual interest in the company after all liabilities are settled.

How do you calculate assets, liabilities and equity?

- The accounting equation also indicates that the company’s creditors had a claim of $7,120 and the owner had a residual claim of $10,080.

- In the coming sections, you will learn more about the different kinds of financial statements accountants generate for businesses.

- The totals indicate that as of midnight on December 7, the company had assets of $17,200 and the sources were $7,120 from the creditors and $10,080 from the owner of the company.

- We also show how the same transaction will be recorded in the company’s general ledger accounts.

Double entry system ensures accuracy and completeness in its accounting system. This methodical approach is fundamental to the accounting system’s integrity. As you can see, assets equal the sum of liabilities and owner’s equity. This makes sense when you think about it because liabilities and equity are essentially just sources of funding for companies to purchase assets. Fees earned from providing services and the amounts of merchandise sold. Under the accrual basis of accounting, revenues are recorded at the time of delivering the service or the merchandise, even if cash is not received at the time of delivery.

This change must be offset by a $500 increase in Total Liabilities or Total Equity. Master the basics of foreign currency accounting—so you can get back to bringing in dollars (or euros, or yen…). You both agree to invest $15,000 in cash, for a total initial investment of $30,000. If you’ve promised to pay someone in the future, and haven’t paid them yet, that’s a liability. Assets are anything valuable that your company owns, whether it’s equipment, land, buildings, or intellectual property.

Formula To Calculate Expanded Accounting Equation :

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. We also allow you to split your payment across 2 separate credit card transactions or send a payment link email to another person on your behalf. If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction. We accept payments via credit card, wire transfer, Western Union, and (when available) bank loan.

- The Framework defines equity as ‘the residual interest in the assets of the entity after deducting all its liabilities’.

- Investors use the balance sheet equation to check a company’s financial setup and value.

- It says a company’s assets must equal its liabilities plus shareholders’ equity.

- The left-side value of the equation will always match the right-side value.

- The totals tell us that the company has assets of $9,900 and the source of those assets is the owner of the company.

- Changes in balance sheet accounts are also used to calculate cash flow in the cash flow statement.

Account

The purchase of a corporation’s own stock will never result in an amount to be reported on the income statement. Therefore, there is no transaction involving the income statement for the two-day period of December 1 through December 2. The purchase of its own stock for cash causes ASI’s assets to decrease by $100 and its stockholders’ equity to decrease by $100. Since ASI has not yet earned any revenues nor incurred any expenses, there are no amounts to be reported on an income statement. In addition, we show the effect of each transaction on the balance sheet and income statement. Starting at the top of the statement we know that the owner’s equity before the start of 2024 was $60,000 and in 2024 the owner invested an additional $10,000.

When inventory items are acquired or produced at varying costs, the company will need to make an assumption on how to flow the changing costs. Since the statement is mathematically correct, we are confident that the net income was $64,000. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Our popular accounting course is designed for those with no accounting background or those seeking a refresher. For example, imagine that a business’s Total Assets increased by $500.

As you see, ACI’s assets increased and its liabilities increased by $7,000. As you can see, ASC’s assets increased and ASC’s liabilities increased by $7,000. You should also include contingent liabilities or liabilities that might land in your company’s lap. This could include the cost of honoring product warranties or potential lawsuits. If you don’t know the value of certain items, you may need to perform research or get in touch with an accountant who can value your assets.

Assets refer to the resources that a company owns or controls and are expected to provide future economic benefits. Some common examples of assets include cash, equipment, inventory, property, buildings, and other tangible assets. Liabilities are obligations that a company owes to others and are expected to be settled in the future. Examples of liabilities include accounts payable, notes payable, and accrued expenses. Handling liabilities well is key to a strong balance sheet and staying financially stable over time. By knowing these parts of the balance, people who invest or lend money can make better choices about a company’s future.

For example, an increase in an asset account can be matched by an equal increase to a related liability or shareholder’s equity account such that the accounting equation stays in balance. Alternatively, an increase in an asset account can be matched by an equal decrease in another asset account. It is important to keep the accounting equation in mind when performing journal entries. The fundamental accounting equation, as mentioned earlier, states that total assets are equal to the sum of the total liabilities and total shareholders equity. Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company.

This process begins with inputting the hours worked, any overtime, and relevant deductions into Xero’s payroll system. Payroll settings such as tax rates, employee benefits, and payment schedules must be accurately configured to ensure compliance with regulations and timely payments. As Xero calculates the pay, it also accounts for any leave taken and calculates the taxes owed.

But it’s worth the cost, because of the advantages it brings.

Employee self-service with cloud payroll

This can be helpful if your company is growing fast, or you simply want the reassurance that there’s no limit to how many people can be part of the team. The Early subscription is tailored for solopreneurs and business owners who are just getting started. You’re able to send 20 quotes and invoices per month, enter five bills, reconcile bank transactions, capture bills and receipts with Hubdoc and view a short-term cash flow and business snapshot. For a small business owner, payroll is a system for paying the correct amounts of money to the right people on the required dates. There are lots of calculations to do, deadlines to meet, and forms to fill out. Encourage them to check that pay, benefits, and taxes are being reported correctly.

- Easy-to-use accounting software, designed for your small business.

- Start by working out what you owe each employee for the period, then make the required deductions.

- Simple sign-up process, where they walk you through each step.

- Compliance checks involve verifying adherence to labor laws, wage regulations, and employee benefits laws, ensuring that the payroll process meets legal standards and avoids penalties or fines.

Automate Your Payroll Process

Before starting work, your employees need to fill out a W-4 form and state tax form. The information they give on these forms helps you figure out how much tax to withhold from their pay. They’re also required to tell you any time there’s a change in their circumstances.

This process is crucial to maintain accuracy and compliance with government regulations. By reviewing each payroll transaction, discrepancies and errors can be identified and rectified, safeguarding the integrity of the payroll system. It provides an opportunity to ensure that all necessary tax withholdings and deductions are in line with statutory requirements. This is where the step-by-step Xero payroll guide becomes invaluable, providing a clear framework for gathering and entering essential employee information.

Choosing the right payroll software

Then again, QuickBooks requires user limits for each plan while Xero doesn’t. We compared the two options in terms of their key features, pricing and customer service to help you decide which is right for your business. Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident integrating with adp workforce now 2021 in your accounting platform when it comes to keeping your information safe. It allows three users for its Essentials plan ($55 per month) and 25 users for its top plan, the Advanced ($200 per month). Xero, on the other hand, offers unlimited users for all plans.

Step 3: Set Up Payroll Settings

Many businesses set up a separate bank account for holding that money to avoid spending it. Xero does not provide accounting, tax, business or legal advice. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided. Automate taxes, deductions and filings with Xero payroll software.

Adjusted Trial Balance Example

The preparation of the statement of cash flows, however, requires a lot of additional information. Preparing an adjusted trial balance requires attention to detail to avoid errors in your financial statements. If you’re unfamiliar with adjusting entries or balancing accounts, work with a small business accounting professional to ensure your records are accurate from the start. Both the debit and credit columns are calculated at the bottom of a trial balance.

If the adjustment process becomes too complex, an accounting professional can help you ensure your records stay accurate for stronger financial management. Reliable reporting leads to better business decisions and long-term success. Once you have the unadjusted trial balance, adjustments are needed to account for transactions that occurred during the period but have not yet been recorded. Once the adjusting entries are completed, the business now has a completed adjusted trial balance. Now that the trial balance is made, it can be posted to the accounting worksheet and the financial statements can be prepared. As with all financial reports, trial balances are always prepared with a heading.

Manage your inventory and business easier

The format of an adjusted trial balance is same as that of unadjusted trial balance. These examples will show you how to adjust an unadjusted trial balance looks like. After incorporating the adjustments above, the adjusted trial balance would look like this. After incorporating the $900 credit adjustment, the balance will now be $600 (debit). He makes the following journal entry, debiting sales revenue and crediting unearned revenue. Starting with depreciation, definition of adjusted gross income he knows that he needs to account for $750 of depreciation per month.

Once it’s complete and financial statements are generated, it’s time to close the books and start looking forward. The adjusting entries are shown in a separate column, but in aggregate for each account; thus, it may be difficult to discern which specific journal entries impact each account. With an adjusted trial balance, necessary adjusting journal entries are incorporated in the trial balance.

Enlist our outsourced accounting services to improve your financial planning and ensure that your trial balances show profitable performance. Once you’ve double checked that you’ve recorded your debit and credit entries transactions properly and confirmed the account totals are correct, it’s time to make adjusting entries. This means that for this accounting period, there was a total inflow (debit) of $11,670 into the cash account.

Reporting Compliance & Anomaly Detection

- After making the adjusting entries, the debits and credits are still equal—an indication that the work was completed properly.

- It is usually used by large companies where a lot of adjusting entries are prepared at the end of each accounting period.

- If you’ve ever wondered how accountants turn your raw financial data into readable financial reports, the trial balance is how.

- This process helps in preparing accurate financial statements and detecting any discrepancies in the accounting records.

If you use accounting software, this usually means you’ve made a mistake inputting information into the system. Here we’ll go over what exactly this miraculous document is, how to create one, and why it’s such an important part of accounting. Learn how out-of-country businesses can obtain foreign qualification in New York, including legal steps, compliance, and registration requirements. The adjusted trial balance for Bold City Consulting is presented in Figure 1. The adjustments need to be made in the trial balance for the above details. Depreciation is a non-cash expense identified to account for the deterioration of fixed assets to reflect the reduction in useful economic life.

By adjusting the trial balance for accrued revenues, expenses, and other necessary items, you can ensure that your financial records reflect the true state of the business. This process helps in preparing accurate financial statements and detecting any discrepancies in the accounting records. This initial trial balance includes all the ledger balances before any adjustments are made. List each account and its balance, and ensure that the total debits equal total credits. Before preparing the financial statements, an adjusted trial balance is prepared to make sure total debits still equal total credits after adjusting entries have been recorded and posted. The post-closing trial balance contains only balance sheet accounts, as all temporary accounts (revenue, expenses, and dividends) have been closed to the retained earnings account.

- By understanding its components, types and the emerging trends in accounting practices, one can appreciate the importance of this financial statement in maintaining sound financial records.

- The trial balance is at the heart of the accounting cycle—a multi-step process that takes in all of your business’ financial transactions, organizes them, and turns them into readable financial statements.

- In this example, the Adjusted Trial Balance would show total debits and credits equal to $30,000, confirming the accounts are in balance.

- Such types of transactions are deposits, Closing Stocks, depreciation, etc.

- Searching for and fixing these errors is called making correcting entries.

Differences between unadjusted and adjusted trial balances

To exemplify the procedure of preparing an adjusted trial balance, we shall take an unadjusted trial balance and convert the same into an adjusted trial balance by incorporating some adjusting entries into it. To simplify the procedure, we shall use the second method in our example. After making the adjusting entries, the debits and credits are still equal—an indication that the work was completed properly. For manual accounting processes, creating the adjusted trial balance is the finalization of the numbers for a period in time. This makes the document the source of truth that all financial reports are ultimately built off of. But financial statements and calculating ratios need to come from finalized, reviewed numbers.

Part of the process of getting there is preparing an adjusted trial balance. Once all the accounts are posted, you have to check to see whether it is in balance. Creating an adjusted trial balance involves several steps, which we’ll outline below.

Adjusting entries are journal entries that account for non-monetary transactions. An adjusted trial balance finalizes account balances and is the last step before generating key financial statements. Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced. Trial balances help ensure the accuracy of data that appears on balance sheets. Balance sheets summarize the highlights of data provided on trial balances. It’s called a “trial” balance, because it allows bookkeepers to test the mathematical accuracy of account information before preparing balance sheets and other financial statements.

Wrap Up Your Records the Right Way

It will create a ledger of all your transactions and turn them into financial statements for you. Journal entries are usually posted to the ledger on a continuous basis, as soon as business transactions occur, to make sure that the company’s books are always up to date. An adjusted trial balance is prepared using the same format as that of an unadjusted trial balance.

The unadjusted trial balance lists all of the accounts and their balances before any adjustments are made. At this stage, businesses review the debits and credits to ensure they are balanced. Such types of transactions are deposits, Closing Stocks, depreciation, etc. Once all necessary adjustments are made, a new second trial balance is prepared to ensure that it is still balanced.

Its purpose is to ensure that the total amount of Debit Balance in the general ledger is equal to the total amount of Credit Balance in the general ledger. Trial balances help companies evaluate financial performance by providing preliminary data on account balances before financial statements are finalized. This information can be used to compare account balances to previous periods, enabling financial analysts to identify trends and opportunities for investment or improvement. For example, trial balances indicating strong cash assets may suggest opportunities to invest in new projects, while balances showing excessive expenses may suggest candidates for cost-cutting. These statements can be especially useful for these purposes, because they represent current data on assets and liabilities, enabling companies to seize immediate opportunities. A post-closing trial balance is a listing of all balance sheet accounts and their balances after the closing entries have been made at the end of an accounting cycle.

The business’s commercial services are cash flow and budgeting, tax preparations, financial statements, tax compliance, and payroll services. Personal services are tax assistance, tax compliance, and financial planning. Linda has over 30 years of experience as a CPA and she is a member of the American Institute of Certified Public Accountants and the Washington State Society of Certified Public Accountants. Linda M. Teachout, CPA, PLLC is accredited by the Better Business Bureau and has an A+ rating. Overall Office Solutions is a Kent business that has been serving small businesses for over seven years. The business offers bookkeeping services and packages are basic bookkeeping, mid-level bookkeeping, and advanced bookkeeping.

Professional bookkeeping & accounting with a personal touch.

Let’s chat about how we can help get your business accounting back on track and getting you back to doing what you do best. We have the experience and knowledge to tailor our processes to match your needs to provide you reliable results.

- George Dimov, CPA, offers bookkeeping services to commercial clients in Seattle.

- Once we have everything set up, we’ll complete a month of your bookkeeping.

- With Bench, you get a team of real, expert bookkeepers in addition to software.

- Florina has more than 15 years of tax and accounting experience and is a Certified QuickBooks ProAdvisor.

- Clients appreciate their efficiency, reliability, and professionalism.

- Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs.

Service Providers

This is where our team of experts can help you determine what taxes you need to pay and how much you owe. Cheryl’s personable attention and wide experience in the Seattle area in accounting will be a strong asset to your Seattle business. Her understanding of up-to-date tax laws and small business requirements will save you time and money. You are guaranteed to receive efficient, honest bookkeeping services that will ensure your satisfaction.

What is double entry bookkeeping?

Overall Office Solutions also offers stand-alone services which include notary services, payroll processing, reconciling, and QuickBooks set-up. Nancy Morelli has more than 20 years of accounting and administrative experience. Overall Office Solutions is accredited by the Better Business Bureau and has an A+ rating. Honest Buck Accounting is a Seattle business that has been serving clients for over eight years. The business’ services include bookkeeping, CPA services, and taxes.

We went through 5 different bookkeepers in the first four years of our business and then we found Vanessa. I have to say hiring Vanessa as a bookkeeper for our company was one of the best decisions of my life. It has been almost 10 years now and I https://www.bookstime.com/articles/financial-leverage sleep very well knowing that our books are under Vanessa’s control. She is always there for you, ready to answer any questions, always professional and very effective. With Bench, you get a team of real, expert bookkeepers in addition to software.

Bookkeeping services include income statement, general ledger maintenance, income statements, and checks and balances. Honest Buck Accounting offers an initial consultation and has three packages. Florina’s Accounting & Tax Services LLC is a Normandy Park business that serves individuals and businesses. Services include tax planning and consulting, business tax returns, individual tax returns, bookkeeping, payroll, QuickBooks set-up and training, and small business accounting. Florina has more than 15 years of tax and accounting experience and is a Certified QuickBooks ProAdvisor.

What does a bookkeeper do for a small business?

Please take a minute to provide your email to begin receiving our newsletter which also offers assistance with tax preparation, tax filing deadlines, and provides valuable free resources. Your bookkeeping team consists of 3 professionally trained bookkeepers, including one senior bookkeeper who reviews all of your monthly statements and your Year End Financial package. We’ll take bookkeeping off your plate so you can focus on the more important parts of the business while we handle the complexities and nuances of Washington State taxes. Vazquez & Co. is a Seattle CPA firm that has been serving small businesses for over 19 years.

Based in Washington, we are the premiere choice for high-quality bookkeeping done fast and accurately.

You’ll always have the human support you need, and a mobile friendly platform to access your up-to-date financials. There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct. If you need to share files with your seattle bookkeepers bookkeeping team, it’s as simple as uploading a file. Seattle based businesses are able to take advantage of Washington State’s no corporate tax and personal income tax laws. However, despite this tax advantage compared to most other states, businesses in Seattle may still be subject to taxes.

Is bookkeeping hard?

Your Balance Sheet, LLC is an Everett business that has been serving the Greater Puget Sound area for over 18 years. Your Balance Sheet, LLC is accredited by the Better Business Bureau and has an A+ rating. The business has won numerous awards including Best of Mukilteo in 2014 and 2015 that was presented by Best Businesses and Accounting Service in 2015 presented by the Seattle Award Program. Clients appreciate their efficiency, reliability, and professionalism. George Dimov, CPA, offers bookkeeping services to commercial clients in Seattle.

We work exclusively with nonprofits, so we understand the unique complexities of your organization’s financial situation and can use our experience to develop tailored solutions for your needs. Your nonprofit’s budget should be organized to align with other key financial resources, including your internal records, accounting services for nonprofit organizations financial statements, and tax returns. Therefore, it’s most effective to categorize the revenue side by source. Yes, profit in a charity is perfectly acceptable as long as those profits are used for the nonprofit’s charitable purposes and not for the benefit of the Board or key staff. In fact, healthy nonprofits will do this to help fund 3-6 months of operating reserves. There are a number of tools that can assist in creating a nonprofit budget.

Develop draft expense budget

Using these programs, you can easily set up financial reports that display the organization’s finances over time, track expenses and revenue, and create graphs that display your financial data over time. The Vermont Community Foundation offers a sample organizational budget template designed to assist nonprofits in planning their annual financial activities. This sample budget outlines various categories for both income and expenses, providing a clear framework for organizations to project their yearly financial operations. The template is aimed at helping nonprofits organize their financial records efficiently, ensuring they can track funding sources, manage expenditures, and plan effectively for future financial needs.

Understand Your Organization’s Goals

- Then, add them together with your existing expenses, such as rent, bills, and salaries for your current staff members.

- Once expenses are categorized, determine the amount you will allocate to each area.

- Capital grants are usually for large-scale items like construction, renovations, or equipment.

- Creating and making the most of a nonprofit budget isn’t a one-and-done job.

- List income sources and figures in monthly columns to determine month-by-month total income.

A capital budget typically includes things like building new facilities or acquiring new equipment needed to meet the demands of increased demand for services provided by the nonprofit organization. Like many businesses, nonprofit organizations often lack the resources and funding to do everything they want. As a result, they need to evaluate their budget and make cuts while continuing to grow.

Different Budgeting Techniques

Donors are particularly interested in your organization’s budgeting principles and how your budget tracks over time. Good financial practices encourage donors considering where https://namesbluff.com/everything-you-should-know-about-accounting-services-for-nonprofit-organizations/ to send their discretionary dollars. More importantly, nonprofit budget best practices instill confidence in your board — whose members often are supporting donors themselves and responsible for fundraising. A critical component of budgeting is projecting your expected income for the upcoming period. For nonprofits that depend heavily on fundraising, donations, and grants, estimating income accurately is especially important for financial planning. Capterra’s Nonprofit Grant Budget Template is designed to aid nonprofits in planning and managing their grant funding effectively.

- Use a spreadsheet or budgeting software to organize the information, making it easier to review and adjust as needed.

- When it comes to budgeting, context is essential when considering every item.

- Seeing these things side by side gives you the tools to decide how you can best use your resources.

- Limelight’s ready-to-go financial planning and analysis (FP&A) packages are offered at a one-time, fixed fee.

- An excellent example of an effective budget narrative is offered by the Rose Community Foundation in Denver, CO.

A cash flow budget is focused on covering big expenses like capital projects or payroll work. It’s meant to help you manage your cash flow so that you can run smoothly while achieving the goals you have set out for your organization. For example, if the organization’s major sources of income are donations and grants, then the budget may need to include funds for fundraising activities and grant writing. Budgeting for a surplus allows you to support future innovations and invest in your staff. The goal is to avoid the “nonprofit starvation cycle” of never having enough to invest resources in infrastructure, or having an overhead that is “too lean” to effectively run the organization. Involve your Board, your staff, and your volunteers in creating the budget and reviewing your revenue and expenses.

Types of Nonprofit Budgets and How to Create Them

A budget for non-profit organizations must balance multiple priorities while maintaining clarity and usability. Several key features distinguish effective nonprofit budgets from basic financial plans. The template’s operating expenses section allows you to easily determine your rolling cash balance. Use this basic sample annual nonprofit budget template with sample text to guide you through the process of balancing your nonprofit’s budget. Relay is an online business banking and money management platform that offers no-fee business checking and savings accounts. We’ve already talked about managing your budget with Relay, but we know nonprofit financial management doesn’t stop there.

Use a format that lets you budget your activity per month rather than on an annual basis so you can track your monthly progress. You’ll be able to make adjustments earlier, like reallocating funds or planning to raise more revenue. Focusing on shorter time periods helps break down your monthly activities and account for special events or one-time costs. Propel Nonprofits is an intermediary organization and federally certified community development financial institution (CDFI). Each program’s manager can develop their respective program’s budget and then turn it in to your executive director for approval. These become part of the overall organizational budget and are used to evaluate the program’s financial effectiveness.

Nonprofit Website Redesign Guide: Avg. Costs, Best Practices & Examples

Many nonprofits seem to not only operate on shoestring budgets but are also proud of it. Some nonprofit leaders may even be reluctant to show a surplus in their books, fearing the perception that they are not putting their resources to good use. When budgeting, nonprofits sometimes make the mistake of forgetting to account for in-kind donations or volunteer hours.

- For example, if you tell your donors that all donations will go directly to program expenses, those are then restricted funds that you need to exclusively use to support programs.

- Show donors exactly how their money is spent and the impact it creates.

- Funds raised may come from ticket sales, membership fees, proceeds of auctions, galas, sales of goods or services, or other fundraising activities.

- Grant-makers have the potential to contribute large sums to nonprofits and board directors should ensure that they meet the grantor’s requirements to qualify.

- These tools notify teams when overspending occurs—such as spending more than 60% of a grant in Q1—and send alerts about upcoming reporting deadlines.

Identify Key Stakeholders

The term “capital budget” might make you think of capital campaigns—the largest fundraising initiatives nonprofits typically run. We’ve rustled up several examples of great nonprofit budget templates for your use as you embark on your fiscal planning journey. A nonprofit operating budget a.k.a. an annual budget is a board-approved document that tracks all expenses and revenue of the nonprofit as a whole.